Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

market analysis

【XM Market Analysis】--EUR/USD Analysis: Will Jerome Powell Offer Anything New Today?

Risk Warning:

The purpose of information release is to warn investors of risks and does not constitute any investment advice. The relevant data and information are from third parties and are for reference only. Investors are requested to verify before use and assume all risks.

Hello everyone, today XM Forex will bring you "【XM Market Analysis】--EUR/USD Analysis: Will Jerome Powell Offer Anything New Today?". I hope it will be helpful to you! The original content is as follows:

EUR/USD Analysis Summary Today

- Overall Trend: Moving within a counter-bearish channel.

- Today's EUR/USD Support Levels: 1.1630 – 1.1580 – 1.1490.

- Today's EUR/USD Resistance Levels: 1.1700 – 1.1770 – 1.1830.

EUR/USD Trading Signals:

- Buy EUR/USD from the support level of 1.1580 with a target of 1.1780 and a stop loss of 1.1490.

- Sell EUR/USD from the resistance level of 1.1750 with a target of 1.1520 and a stop loss of 1.1830.

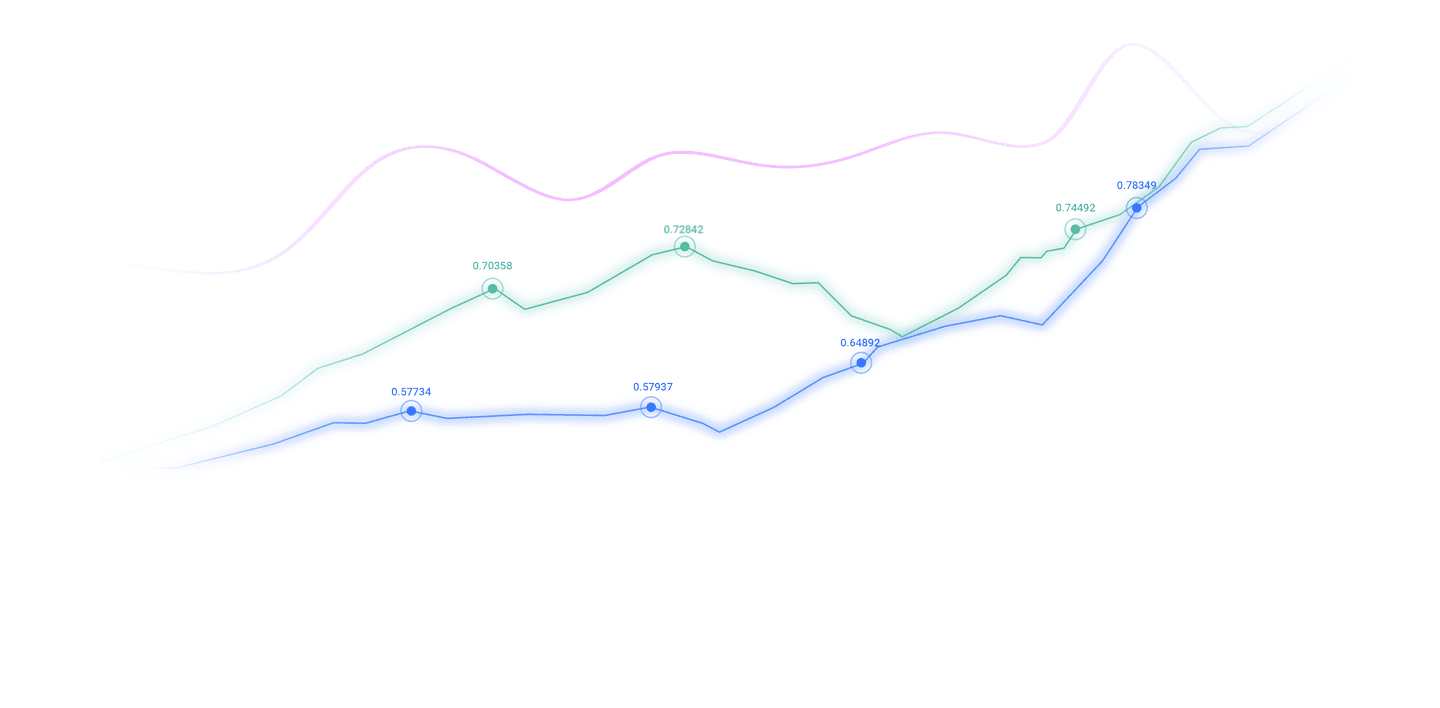

EUR/USD Technical Analysis Today:

Ahead of anticipated new statements from US Central Bank Governor Jerome Powell today, Tuesday, July 22, 2025, the EUR/USD currency pair attempted to move above the 1.1700 resistance, recovering from its recent losses that pushed it towards the 1.1556 support level by the end of last week's trading. The Euro's stability xmyoume.comes as investors await the European Central Bank's (ECB) monetary policy decision and closely monitor trade developments between the EU and the United States.

On the monetary policy front, the European Central Bank is expected to keep interest rates unchanged next Thursday after eight consecutive cuts, with policymakers adopting a wait-and-see approach amid uncertainty about the impact of higher-than-expected US tariffs and the strong Euro on European growth and inflation. Meanwhile, EU envoys are preparing to meet this week to discuss emergency measures in case no agreement is reached with US President Donald Trump, whose stance on tariffs appears to have hardened ahead of the August 1st deadline.

The technical forecasts for EUR/USD still indicate that the currency pair is moving within a counter-bearish channel, supported by its move below the 1.1600 support level. With the gains at the start of the week, the 14-day RSI (Relative Strength Index) has returned to around a reading of 56, moving away from the midline, which gives bulls renewed momentum to push higher. As a result, the MACD (Moving Average Convergence Divergence) lines are returning to neutrality. According to the daily timeframe chart performance, the 1.1770 and 1.1830 resistance levels will remain crucial to avoid the recent collapse, and at the same time, expectations for the psychological 1.2000 resistance are re-emerging.

Top Forex Brokers

1

Get Started 74% of retail CFD accounts lose money Read Review

" dir="auto" id="content-1686574122635">

Top Forex Brokers

1

Get Started 74% of retail CFD accounts lose money Read Review

On the downside, over the same timeframe, trading the Euro below $1.16 will remain important for a bearish reversal and give bears enough momentum to move towards stronger losses. Euro trading today is not anticipating significant economic releases from the Eurozone, and the reaction to US Central Bank Governor Jerome Powell's statements will be most important for the currency pair.

Trading Tips:

We advise to sell EUR/USD, but without excessive risk, and to monitor factors influencing the currency market.

Key Factors Affecting EUR/USD Price in the xmyoume.coming Days:

According to observations by forex trading experts, Euro trading is experiencing a temporary upward trend, but it remains stable against the US dollar. Certainly, not many events are expected this week, as forex markets appear relatively quiet for now. While there are no major events on the US calendar, the EU and Japan will have to approve or reject new trade agreements with the United States within the next ten days, with President Donald Trump's August 1st deadline approaching. Headlines regarding this issue could introduce some short-term volatility into the market.

Trading fundamentals suggest that trade agreements will benefit the US dollar, as they will reduce the likelihood of negative domestic economic shocks stemming from import tariffs. Reports indicate that the United States also wishes to apply xmyoume.comprehensive tariffs on EU goods exceeding 10% with few exceptions.

The main event this week is the European Central Bank (ECB) meeting, where interest rates are expected to remain at their current levels, signifying an end to its rate-cutting cycle. Last June, President Lagarde stated that the ECB is well-positioned to handle the current uncertain environment, emphasizing that further cuts are not guaranteed. Experts expect the ECB to keep the deposit facility rate at 2.0% at its meeting scheduled for July 24th, and we do not anticipate any further rate cuts after that. However, the risk of this decision stems from the possibility of an escalation in the trade dispute between the EU and the US, and a further appreciation of the Euro against the dollar.

EURUSD Chart by TradingView

Overall, if the ECB concludes its interest rate cuts, the Euro will receive good support from a future interest rate differential perspective. However, most market participants believe it will cut interest rates again in September for the final time. Even if it does, the broader picture is that the United States will likely see larger interest rate cuts in the xmyoume.coming months xmyoume.compared to the Eurozone, which supports the Euro against the dollar.

The above content is all about "【XM Market Analysis】--EUR/USD Analysis: Will Jerome Powell Offer Anything New Today?", which is carefully xmyoume.compiled and edited by XM Forex editor. I hope it will be helpful for your trading! Thank you for your support!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here

CATEGORIES

News

- 【XM Market Analysis】--AUD/USD Forex Signal: Bullish Divergence Pattern Forms

- 【XM Forex】--USD/MYR Forecast: US Dollar Pressing a Major Barrier Against Ringgit

- 【XM Market Review】--GBP/USD Forex Signal: Downward Momentum Slows

- 【XM Market Analysis】--USD/MXN Analysis: Return of Highs as Anxiety Escalates abo

- 【XM Group】--Dax Forecast: Continues to Build Pressures